Copyright © Hong Kong Air Cargo Industry Services Limited. All Rights Reserved.

All change at Finnair Cargo

Finnair is a changed airline. Once heavily focused on maindeck capacity, its decision to make the Airbus A350 the backbone of its intercontinental operations means the freighters have all but disappeared.

But nobody should take that as a signal that Finnair is any less serious about cargo. Quite the opposite, in fact: it has a brand new cargo terminal at its Helsinki hub, more linehaul capacity to offer than ever before, and a new man driving it all: Janne Tarvainen, its Managing Director Cargo since 2015.

Janne has been in aviation since 1994, and with Finnair since 1997. He has held a fascinating array of positions, including working on the management of engines, components, aircraft maintenance, and ultimately overall in charge of Finnair’s Operations Control Centre, which he re-modelled to provide improved efficiency and operational quality.

It was in 2015 that he was summoned to head up Cargo, and he hasn’t looked back: “I knew the airline operations very well, and cargo operations quite well. But I had no deep understanding of the cargo business. So I built a new team that brought all the necessary knowledge. Cargo is a very, very exciting business, and I am enjoying it a lot!”

45% capacity growth

Janne explains the massive change that Finnair Cargo is undergoing: “It was our decision in late 2014 to get rid of the freighters, and support the main airline operations with cargo carried in bellies,” says Janne. “We have a growing A350 fleet; currently it’s eleven aircraft, but it will be nineteen by the end of 2023. That means we will already have 45% growth in cargo capacity by 2020, compared to the pre-A350 period.”

And what about the A350 - this relative newcomer to the air cargo scene? “As the cargo arm of a largely passenger-driven carrier, our aim is to provide the best possible support for existing services. On widebody intercontinental operations, cargo contributes some 15 to 17% of revenue, and we are certainly listened to in planning discussions. The A350 is supporting our task very well due to its improved range and cargo capacity.” The A350 is replacing A340s – a type well-liked by cargo managers. But, despite the switch from four engines to two, the A350 matches the A340’s payload and range, and adds a useful extra 10 cbm of space.

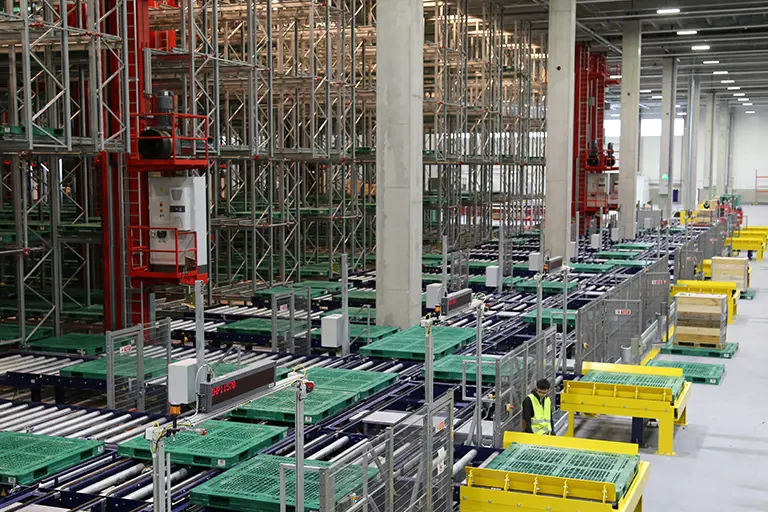

Filling all that extra capacity is one thing. But handling it is quite another. Finnair was getting close to capacity at its old cargo terminal, and that threatened to thwart its growth plans. Enter what Janne now describes as the most modern air cargo terminal in Europe: the aptly-named COOL Nordic cargo hub (to give it its official title).

COOL terminal key to future

Already handling general cargo, COOL terminal will fully open in January 2018, when it will double throughput capacity to around 350,000 tonnes per annum. Covering 31,000 sq m, it incorporates 25,000 sq m of general cargo space, along with two temperature controlled zones of 3,000 sq m each, for pharma and perishables: both prime targets for future growth.

“Pharma is a growing area that commands a yield premium; we believe we can provide high quality services due to the size of our network, the frequency of services, and our high reliability.” Finnair Cargo has established an “extended home market” in Brussels, served by freighters as well as narrowbody passenger flights, especially supporting the pharma industry around Brussels with product for Asian markets. And Janne is quick to point out that Finnair was the very first airline to gain IATA CEIV Pharma accreditation.

As for perishables, “More than 30% of the cargo leaving Europe is seafood,” continues Janne. “Mainly from Norway, but other origins as well. This has to do with our ability to move cargo from northern Norway to markets like Japan, which we reach in 34 hours. We offer a very short connection to many Asian markets, again due to our location.”

Finnair Cargo has built its business on transhipment over its Helsinki hub, and that was also a major driver of COOL terminal’s design, continues Janne: “Something like 80% of our cargo is transhipment, and that’s one of the features we took into account when designing the facility. COOL terminal will have a significant impact on our competitiveness.”

COOL terminal is the result of extensive visits to other modern air cargo terminals, and some even outside the air cargo industry. It features extensive storage automation, as a response to Finland’s very high labour costs. “We looked at the options available to us,” continues Janne, “and we tried to envisage what excellence would look like in the future: particularly levels of digitisation, and data accuracy and availability. We took examples of best practice also from our own airline’s operations, which already have a proven track record. We also learned from visiting the Hactl terminal in Hong Kong.”

With its new terminal, Finnair moves to an advanced era of planning and managing cargo flows. All elements are included in a new production management system: trucks, forklifts, container building and unloading, as well as airport transfers. These are all controlled by a new IT system that will optimise efficiency. “This is a foundation from which to take the next steps,” continues Janne.

Pharma is a growing area that commands a yield premium; we believe we can provide high quality services due to the size of our network, the frequency of services, and our high reliability.

Hong Kong and Hactl: set for even greater importance

Hong Kong is a very important market for Finnair Cargo, with twice daily A350s. It ranks 4th for cargo production in a network of 67 stations - with only China, Norway and Japan ahead of it. In fact, it even beats Finnair’s home market! Hong Kong is part of a wider focus on China, where the airline already serves five destinations and is about to add a sixth. “Hong Kong and China together are our most important region, and the one where Finnair feels it has the biggest edge over other carriers, due to its location on the Great Circle Route.” And Hong Kong could become even more important, if recent talks with Hactl subsidiary Hacis result in Finnair using its well-established road feeder service system to penetrate the Pearl River Delta region: a future hotspot when the much-publicised Hong Kong-Zhuhai-Macao Bridge opens, and slashes end-to-end truck transit times by two thirds.

Janne admits he is impressed by Hactl’s operation. “Hactl’s way of working with so much automation is very, very impressive. It’s why we call our new COOL terminal the most modern in Europe, and not the world!” And Janne is confident the relationship with Hactl will grow, largely based on their shared commitment to increased transparency and data availability. “That’s the direction, and it requires harmonisation. Hactl is one of the most sophisticated organisations in the industry, and therefore is well able to support this process.”

Hactl’s way of working with so much automation is very, very impressive. It’s why we call our new COOL terminal the most modern in Europe, and not the world!

Harmony... and disruption

Despite the theoretical opportunities for interlining with other Hactl-handled carriers, Janne was surprised at how little such activity takes place at all in the industry at present, compared to the passenger side of aviation. “I guess it’s an opportunity” he admits – although he suggests that wider take up across the industry demands action on IT. “It’s one of the disappointments, but there are issues behind it. A modern system like ours requires excellent data discipline and quality, which is not exactly the case with all the data you receive. Harmonisation would make interline more viable.”

Gazing into the future, Janne says: “We have an excellent network, the business is full of new opportunities, and our new terminal will be fully open in January. I’m focused in the short term on getting it all up and running. After that, I want to deliver more services that add value to our customers.

“We must also see how the world looks in the next couple of years. There is disruption, and this will have an impact on our old fashioned air cargo industry. We want to be part of the disruption, and you’ll hear more about that in the future!”

We have an excellent network, the business is full of new opportunities, and our new terminal will be fully open in January...